Record Level Industrial Construction Increases Metro Phoenix Vacancy

Metropolitan Phoenix has been experiencing record-breaking levels of industrial construction, leading to an increase in vacancy rates across the Valley of the Sun, as outlined in a report by Colliers. In the first quarter alone, 9.7 million square feet of new space were completed, causing the vacancy rate to rise by 140 basis points to reach 8.1 percent. Notably, Amazon’s leasing of 3.4 million square feet during the same period helped stabilize the vacancy rate, preventing it from further escalation.

During the first three months of 2024, 9.7 million square feet of new development were completed with just 24.3 percent pre-leased. An additional 33.0 million square feet of industrial space are currently under construction, 3.0 of which was started during first quarter of this year. Approximately 26.7 percent of the space underway is pre-leased. The current level of 33.0 million square feet under construction is a 29.3 percent decrease in activity compared to first quarter of 2023. The market has added 63.8 million square feet in the past two years, which represents 15.4 percent of the entire Metro Area inventory.

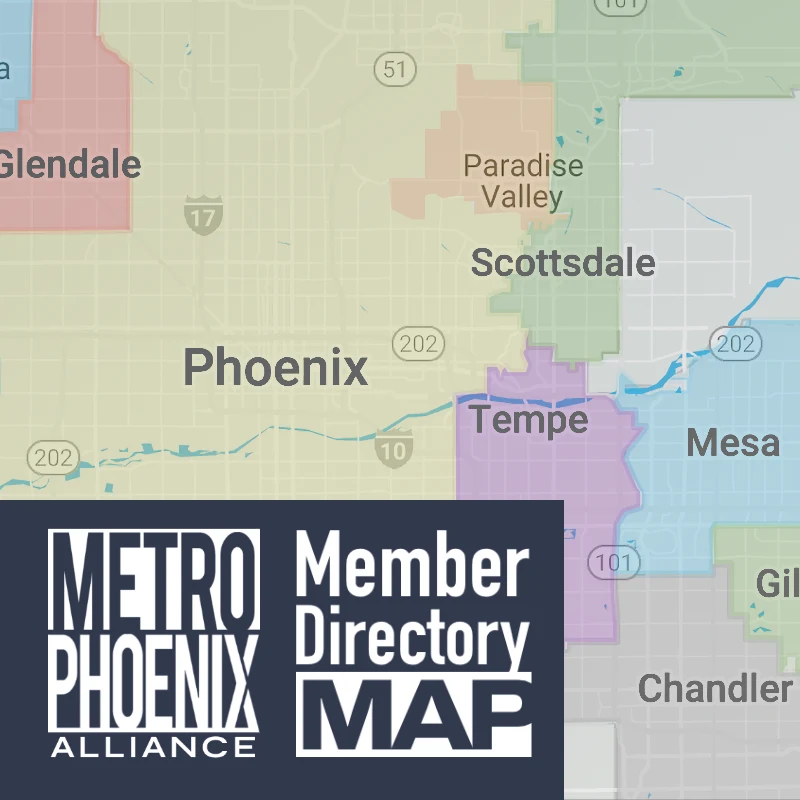

Deliveries of new space have outpaced leasing activity, pushing vacancy to reach its highest level since 2017. The 8.1 percent current vacancy marks a 510 basis point increase year-over-year. Existing buildings smaller than 200,000 square feet have just 5.5 percent vacancy, compared to buildings larger than 500,000 square feet that post 12.2 percent vacancy. Currently there are 13 fully vacant existing buildings larger than 500,000 square feet, totaling 9.7 million square feet and comprising nearly 30 percent of the direct vacancy in the market. The highest vacancy is found in the Southeast submarket. This area delivered more than 11.9 million square feet of new space during the past five quarters and has a 10.5 percent vacancy.

First quarter marked the 16th consecutive quarter of net absorption surpassing one million square feet. During the first three months of 2024, the market posted 4.4 million square feet of net absorption, outpacing the past three quarters but falling short of first quarter 2023. The market benefitted from a drastic rise in big box tenant activity during the last 45 days of the quarter. This propelled leasing activity to 7.3 million square feet and nine of the 10 largest deals were located in the West Valley. Amazon signed the three largest leases of the quarter, each more than a million square feet and totaling 3.4 million. Amazon committed to two existing buildings and one that is under construction, concentrated around Loop 303. Amazon’s transactions accounted for more than 45 percent of the industrial space leased during first quarter.

Industrial rental rates continue to rise, but at a significantly healthier pace than experienced in 2023. Rental rates at the end of first quarter averaged $1.09 NNN, marking a 3.1 percent quarter-over-quarter increase and a rise of 10.3 percent year-over-year. Overall industrial rental rates have increased 47.3 percent since first quarter 2021. Every asset type and submarket cluster has experienced stable or rising rental rates year-over-year. Posting its fifth consecutive quarter as leading submarket for rising rates, the Southwest submarket rates jumped 18.3 percent last quarter ending at $0.97 NNN. The large uptick in vacancy has led landlords in certain areas to acknowledge that they now need to compete more for tenants. The shift is forcing concessions and motivating some owners to fully build out vacant space to attract users.

The industrial market posted lower levels of sales volume during first quarter, marking the smallest volume going back to second quarter 2020. Anticipation that the Fed would be cutting interest rates kept a large pool of buyers on the sidelines. Sales volume reached $471 million, which is a 15.2 percent decrease quarter-over-quarter. Prices for the first three months averaged $189 per square foot, a 3.7 percent increase year-over-year. There were four separate portfolio sales during first quarter that collectively created 45 percent of total sales volume. The largest transaction was a six-property sale at El Dorado Tech Center in Gilbert. ViaWest Group acquired the properties totaling 428,453 square feet from Clarion Partners for $71 million ($165/SF.) The Southeast submarket led the quarter with highest sales volume, ending at $221.1 million with an average price of $168 per square foot.

Tenant activity has increased in 2024, which is helping to stabilize the increase of vacancy. However, increased levels of construction in 2023 will bring a wave of deliveries throughout 2024 that will force vacancy rates higher. Greater Phoenix has gained significant national attention with the announcement of CHIPS Act funding for TSMC and Intel. This infusion of capital will benefit us immensely, both with those companies and the ancillary businesses that will need space to support their relationships with the tech leaders.