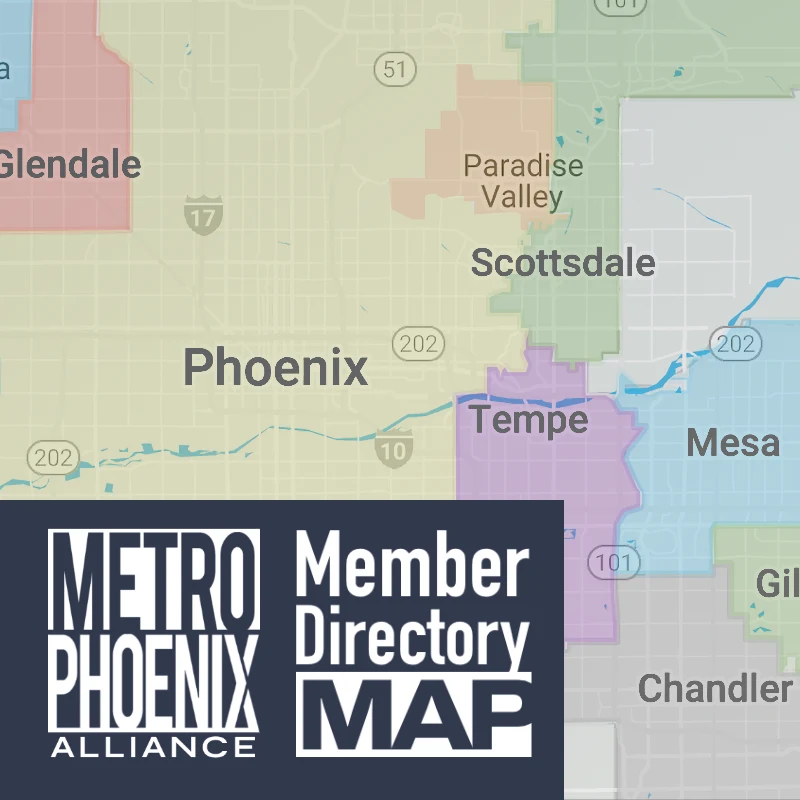

Industrial Construction LGES Queen Creek AZ

Photo provided by Metro Phoenix Alliance.

Demand Continues in 2025

In 2024, Metro Phoenix reached a record high for industrial construction completions, adding 34.8 million square feet of new space to the market and boosting overall inventory by 7.8 percent, as reported by Colliers. Available inventory is expected to lease quickly as strong demand continues.

Approximately 25.5 million square feet of industrial product were under construction at the end of third quarter 2024, which resulted in the market gaining 7.8 million square feet of newly completed space during fourth quarter last year. The year 2024 marks the largest amount of space delivered for the metro area, posting 6.8 million more square feet of completions than 2023. Approximately 32.7 percent of the 7.8 million delivered during fourth quarter was pre-leased. The largest single occupied building that was added is located in Buckeye. The 1.7-million-square-foot distribution center is occupied by Ross Stores. The largest building park delivery during fourth quarter was Luke Field, a three-building project totaling 2.4 million square feet in Glendale. That park was delivered with 100 percent vacancy. Approximately 19.3 million square feet of new inventory are currently under construction with nearly 75 percent of that space located in the Northwest and Southwest submarket clusters.

Fourth quarter 2024 marked the 19th consecutive quarter when net absorption exceeded one million square feet. The final three months of the year posted 3.8 million square feet of positive net absorption, bringing the 2024 total to 15.5 million square feet. The total falls 2.6 percent below the 2023 level. Nearly 60 percent of net absorption last year occurred in the Northwest submarket cluster. The fourth quarter brought 81 industrial transactions and the average deal size was 54,621 square feet. Eleven new direct leases exceeding 100,000 square feet were signed in the final three months of 2024.

Increasing industrial inventory by 7.8 percent during 2024 put pressure on vacancy rates in Greater Phoenix. Approximately 21.8 million square feet of the 34.8 million delivered during 2024 are available for lease. This space represents 46.5 percent of the market’s total vacancy. Direct market vacancy increased 50 basis points quarter-over-quarter in fourth quarter to 10.6 percent. During the past two years, the Phoenix industrial market has added 62.7 million square feet. The vacancy rate in buildings constructed in 2022 and earlier is just 3.4 percent. There are 17 existing buildings available that can accommodate a tenant seeking 500,000 square feet or more. These buildings make up 27.0 percent of the direct market vacancy. Vacancy in buildings smaller than 200,000 square feet is just 7.2 percent.

Increased vacancy in the market brought a softening of rental rates during fourth quarter 2024, marking the first decline since 2017. Average rental rates posted a slight 0.22 percent decrease compared to the previous quarter to end at $1.12 per square foot. While rates dropped over the quarter, there was a 5.9 percent increase in rental rates year-over-year. Overall industrial rental rates have increased 61.3 percent during the past three years. Landlords are responding to tenant desire for move-in ready space and are now buiding out speculative office space, as well as constructing warehouses with LED lighting, insulation, HVAC and dock packages. This is especially true in newer buildings that have sat empty for more than 12 months. Along with move-in ready space, some landlords are providing additional tenant improvement allowances amortized into the rental rates.

While demand for space remains strong, investors are taking more interest in the growing market. Investment sales of industrial space during fourth quarter were the best of the year. The quarter posted the highest sales volume since fourth quarter 2021. During the final three months of the year $1.88 billlion of product was sold, bringing the year’s total to $4.27 billion. Total sales volume for 2024 was 91.8 percent higher than 2023. The average price per square foot rose 6.3 percent to $198.38 during 2024. The Southeast submarket cluster led the market for the second consecutive quarter, posting $1.045 billion in sales during the last three months. This represents 55.5 percent of the Metro Phoenix sales volume. The largest transaction of the quarter and the year was the sale of Broadway 101 Commerce Park. The 807,024-square-foot park was purchased by CIP Real Estate for $168.2 million. Greater Phoenix remains a very strong industrial market for both users and investors. As construction levels decline, existing vacant inventory is anticipated to lease at a steady pace. Shifts in the leasing market have led developers to move away from big box projects towards smaller buildings that are in more demand. The city’s past two years have produced a quarterly average of nearly four million square feet of absorption.