The Next Global Technology Hub?

Metropolitan Phoenix has become one of the premiere manufacturing regions and is on its way to becoming a major U.S. technology hub, according to a new report from CBRE Group Inc.

The Phoenix market is expected to be a major beneficiary of reshoring efforts because of its proximity to Mexico, its lack of natural disasters, skilled labor force, business climate and development opportunities, real estate experts say.

The region has in recent years experienced unprecedented industrial demand and construction, mostly for distribution and logistics users but also from manufacturers.

About 62 manufacturers and 18 advanced manufacturers were considering the Phoenix market in 2023 compared to 18 manufacturers and four advanced manufacturers just five years earlier.

Since 2018, manufacturing space requirements have also increased 107%, while advanced manufacturing space requirements grew by 366%, adding to the increase in demand, CBRE said in its report.

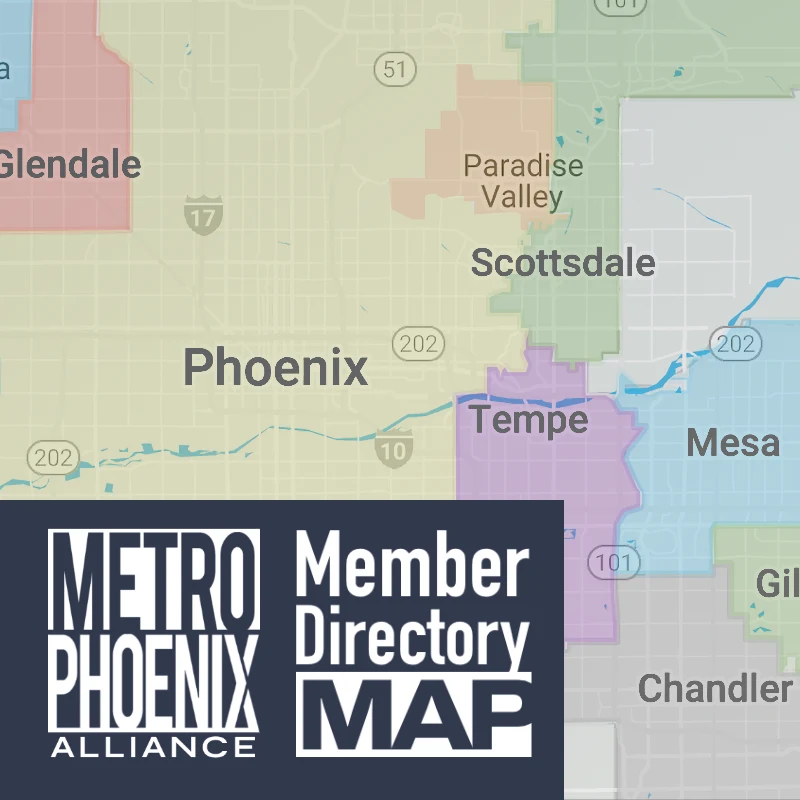

Loop 101 one of top tech corridors identified

Earlier this year, site selection firm The Boyd Company Inc. also released a report identifying operating costs in the top 30 high-tech corridors in the nation, and Phoenix made the list.

Boyd identified the Loop 101 in the East Valley as a key corridor that connects technology and industrial hubs across the metro and listed the estimated annual operating costs for a hypothetical 350,000-square-foot user with 500 jobs at $43.1 million, one of the 10 lowest costs out of the 30 corridors analyzed. The Bay Area Route 101 corridor in northern California was the top at $53.5 million.

“Phoenix is one of the most attractive locations in North America for advanced manufacturing, particularly the types of exciting trophy projects that are our there today — semiconductors, battery projects, the EV industry, the aerospace industry,” John Boyd, principal of The Boyd Company, recently told Phoenix Business Journal.

Boyd said the proximity of Arizona and other border states to Mexico will be advantageous as Mexico emerges as a chief trading partner and alternative to China for a low-cost manufacturing location.

Orcutt said new federal legislation such as the Inflation Reduction Act, as well as state incentives and programs, has helped spur new projects and investment in Phoenix. This includes LG Energy Solution’s 1.4 million-square-foot battery plant that’s expected to create 4,000 jobs and KORE Power’s 2 million-square-foot plant that’s expected to bring 1,250 jobs.

The CHIPS Act is also expected to benefit Arizona and the major $40 billion investment from Taiwan Semiconductor Manufacturing Co. in north Phoenix, which will employ 4,500 people. About 40 suppliers or related companies are also expanding in the area as a result of TSMC.

Manufacturing jobs more than 100% recovered from pre-pandemic

These new projects will only add to major manufacturers already located in the region, including Intel Corp.’s nearly 12,000 jobs; Honeywell’s 7,550 employees; and Boeing’s 4,000 jobs, the report said, citing Maricopa Association of Governments data from 2021.

Although manufacturing job growth is expected to decline by 2% in the next decade across the U.S., according to the CBRE report, Phoenix could be an outlier as it continues to gain jobs in the industry.

The Phoenix area had about 150,000 manufacturing jobs in 2023, according to CBRE data, which makes up about 6% of jobs in the Valley. Manufacturing is one of several key industries for jobs in Maricopa County alongside health care, finance, distribution, information technology and aerospace, according to MAG data.

The 150,000 jobs means Phoenix has recovered more than 100% of manufacturing jobs it had before the Covid-19 pandemic and is closer to a previous peak of more than 160,000 in the early 2000s, the report shows.

Orcutt said the Phoenix economy was historically tied to its housing growth but economic and education leaders have worked to change this following the Great Recession with training and job programs to build up a workforce.

The Chandler-Price Corridor and the Deer Valley corridor in north Phoenix were also identified in CBRE’s report as some of the top high-tech manufacturing hubs in the Valley. The Price Corridor currently has 31 high-tech firms with 11,041 jobs, while Deer Valley has 29 high-tech firms with 4,550 jobs, according to CBRE.

Read more in the CBRE Advanced Manufacturing Report.