State of the Market & Data Center Trends

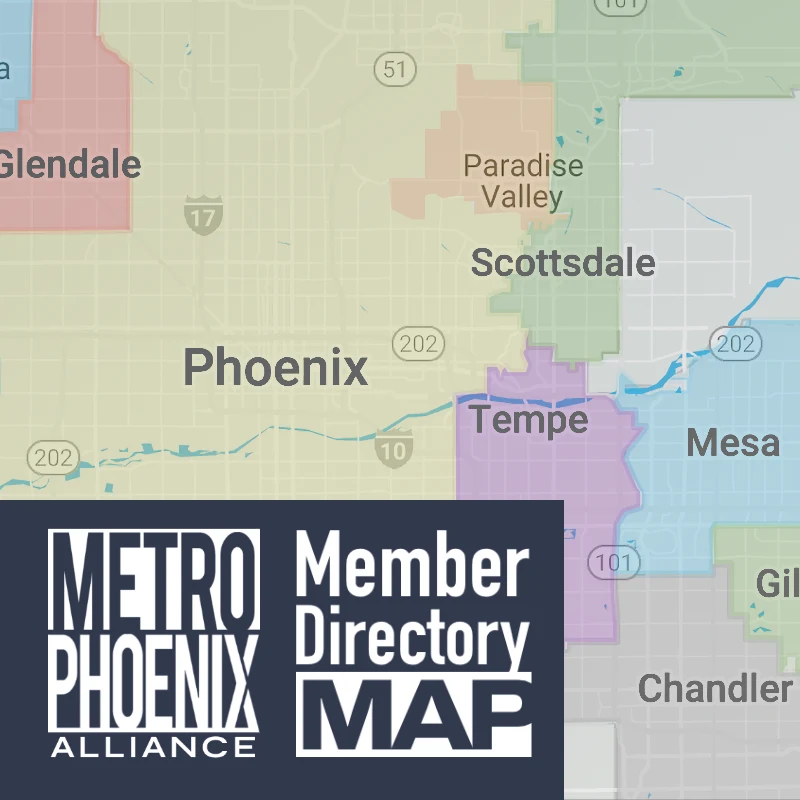

The demand for data centers across North America skyrocketed last year, fueling an unprecedented wave of new construction. Among the most competitive markets, Metro Phoenix emerged as a hotspot, commanding some of the highest average rental rates for facilities consuming 250-500 kilowatts (kW) per month. According to CBRE’s latest North American Data Center Trend Report, lease rates in the region range between $170 and $210 per kW monthly, reflecting the area’s growing prominence as a key data infrastructure hub.

Colocation Insights

Absorption of space and power increased significantly with 242.8 MW of new inventory delivered in 2024.

The average size of lease transactions increased throughout the year as companies expanded their footprint.

Market Trends

Developers and hyperscale companies acquired more sites for new development.

Cities instituted more restrictions on new data center development.

Notable Activity

Microsoft, Compass and Amazon Web Services acquired land for future development.

Solar power providers are utilizing battery storage initiatives to help maximize generation.

Valuation Insights

Owners and operators are increasingly seeking more power and land than ever before. Powered land transactions in the 250-to-500-MW range are the most common, with several deals exceeding this capacity.

Sites that can offer power within the next 18 to 24 months are highly sought after. Power delivery to many sites takes much longer. While location remains an important factor, it has become less critical in site selection. Tertiary and rural markets have seen unprecedented deal activity for powered land.

How much power demand will ultimately arise from the current growth of data centers remains uncertain. Alternative power sources, particularly nuclear, are being evaluated as potentially viable solutions to meet rising demand.

Hyperscalers are pouring record amounts of capital into data centers, spurred by the rapid growth of AI. Increased capital expenditures are expected to create long-term opportunities and greater financial returns in 2025.

According to CBRE, the eight primary North American data center markets are Atlanta, Chicago, Dallas-Fort Worth, Hillsboro, New York Tri-State, Northern Virginia, Phoenix, and Silicon Valley.

Read more in the CBRE North America Data Center Report (H2 2024).